Going through a divorce in Florida can feel overwhelming, especially when it comes to safeguarding your financial assets. Understanding how divorce law in Tampa, FL, impacts asset division and knowing what steps to take with Hunter Law can make a difference. This article discusses the legal strategies for protecting your wealth during a divorce.

Understanding Florida’s Equitable Distribution

Florida is an equitable distribution state. This means that all marital assets and liabilities are divided in your divorce. However, that doesn’t necessarily mean they are divided ‘equally.’ The court takes various factors into consideration when deciding what is “fair.” They look at the length of the marriage, both of your financial situations and the contributions made to the marriage. These contributions can be both financial and as a homemaker. It’s important to know which of your assets may be at risk and to proactively work to safeguard them.

Distinguishing Between Marital and Non-Marital Assets

In Florida, marital assets are generally classified as what you acquired throughout your marriage, from the date of marriage to the date of the filing of the petition for dissolution of marriage. Non-marital assets are those owned before the marriage or received as a gift or inheritance or personal injury settlement. However, if non-marital assets are commingled with marital assets, they may lose their protected status. A good example of this would be if you deposited inheritance funds into a joint account. Maintaining clear documentation of non-marital assets helps family law firms like Hunter Law present your claims effectively.

Steps To Prepare for a Divorce in FL

Preparation is key in protecting your assets and helping our team achieve a fair outcome. Here are practical steps to take as you begin your divorce in FL.

1. Gather Financial Documentation

Florida Family Law Rule of Procedured Rule 12.285 requires both parties to disclose all relevant financial documents, which play a big part in assessing the division of assets. Collect your bank statements, tax returns, investment account records, property deeds, and any documentation related to your assets and debts. This transparency helps create an accurate valuation of your marital estate.

2. Separate Your Finances

Consider opening an individual account to protect your finances. If you currently share accounts with your spouse, shifting your income and personal funds to a separate account can help you manage your assets independently. Take care to ensure the new account is not commingled with marital assets. However, avoid making any significant financial moves without consulting a divorce attorney from Hunter Law to ensure compliance with all legal obligations.

3. Consult the Best Family Lawyer in Tampa, FL

Engaging a knowledgeable divorce attorney is one of the most important steps. A seasoned Tampa divorce attorney from our team at Hunter Law provides you with tailored advice. We guide you through the complexities of divorce in Florida and ensure that your rights and assets are protected. We also help you understand how Florida’s equitable distribution law might apply to your divorce case by offering clarity in an often-complicated process.

Leveraging Legal Tools To Protect Your Assets

Florida law offers several legal instruments that can support your efforts to safeguard your wealth during a divorce. Here are some strategies:

Prenuptial and Postnuptial Agreements

If you have a prenuptial or postnuptial agreement, it can help simplify the division of assets in your divorce. These agreements specify how assets will be distributed, potentially overriding the state’s equitable distribution standards. If you’re concerned about asset protection, discuss your existing agreement or the possibility of creating a postnuptial agreement with your divorce attorneys.

Professional Asset Valuations

For high-value assets such as businesses, real estate, or valuable collections, obtaining a professional valuation can support fair distribution. Accurate valuations are the best way to ensure both parties have a clear understanding of asset worth, preventing disputes down the line. A good divorce lawyer can help coordinate appraisals for significant assets, providing clarity and protection during negotiations.

Protecting Retirement Accounts and Investments

Retirement accounts, pensions, and investment portfolios are usually some of the biggest assets at stake in a divorce in FL. A Qualified Domestic Relations Order, or QDRO, is a court order used to divide certain ‘qualified’ retirement accounts without incurring taxes or penalties. However, taxes and penalties may still apply if the funds are withdrawn from the retirement account after the QDRO is implemented. The QDRO specifies how your retirement plan gets split and directs the plan administrator to distribute funds based on that decision. If you or your spouse hold a 401(k), pension, or some other qualified retirement asset, a QDRO can help protect your portion. Working with a skilled divorce attorney ensures that the QDRO process is handled correctly.

Protecting Your Business Interests

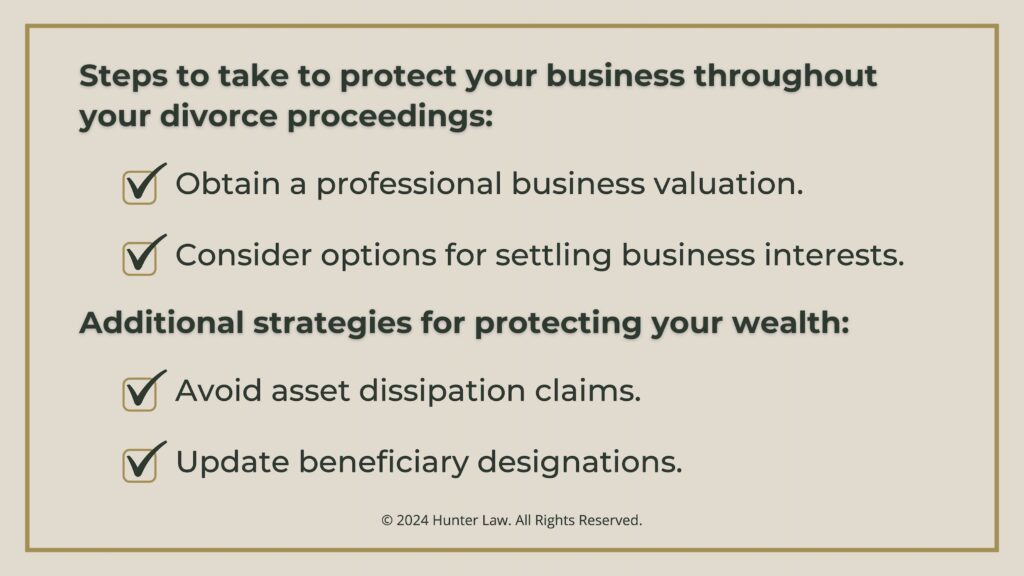

If you own a business, the thought of dividing it in a divorce may weigh on your mind. Here are steps you can take to protect your business throughout your divorce proceedings.

1. Obtain a Professional Business Valuation During Your Florida Divorce Preparations

Understanding the value of your business is the first and most important step. A professional valuation assesses your business’s worth. It takes into account factors such as assets, liabilities, income, and growth potential. This valuation provides a basis for negotiations regarding your business interests.

2. Consider Options for Settling Business Interests

Options such as buyouts, co-ownership, or trading assets may allow you to keep your business intact while satisfying the divorce settlement requirements. As the best divorce lawyers in Tampa, we can guide you through these options, helping you determine the best course of action.

Additional Strategies for Protecting Your Wealth

Here are other important factors to keep in mind throughout your divorce in FL:

Avoid Asset Dissipation Claims

Florida courts discourage what they call “asset dissipation.” This is where one spouse intentionally wastes or hides assets to prevent the other from receiving them. The court has the ability to “look back” up to two years before the date of filing to find instances of waste or dissipation. If you are found guilty of dissipating assets, you could potentially face legal consequences. Always be transparent with your assets.

Update Beneficiary Designations

After your divorce is finalized, review and update beneficiary designations on your insurance policies, retirement accounts, and other financial assets. These can be terms as the “payable on death” or the “transfer on death” beneficiaries on your accounts. This keeps your assets for the intended individuals, aligning with your current wishes and circumstances.

Secure Your Future with the Right Legal Support

Divorce in Florida can be challenging, especially when it comes to protecting assets and planning for your future. By preparing early, consulting with an experienced attorney, avoiding pitfalls, and understanding Florida’s family law, you can safeguard your wealth. At Hunter Law, we’re here to support you through every step. Contact us today to schedule a consultation with our experienced Tampa divorce attorneys.